-

622

InsurTech Solution: Its Emergence & Influence In The Insurance Industry

An all-encompassing guide analyzing InsurTech Solutions and how they’re transforming the insurance industry

The insurance industry is going through an extensive shift triggered by the proliferated adoption of InsurTech Solutions. To harness the optimal potential of these systems, you need to have complete knowledge about them. Thanks to this guide, we navigate you through a comprehensive assessment of the InsurTech system, its role, benefits, and impact on the insurance industry.

A report from Grand View Research states that the global InsurTech Market size was valued at just $5.4 billion in 2022 and is anticipated to reach $152 billion at a CAGR (compound annual growth rate) of 52.7% by 2030. Isn’t it proliferating?

InsurTech software solutions enable insurers to serve their new and potential customers the way they should. Apart from that, the system empowers them to compete with new competitors penetrating the market, deal with them, and embrace success with ease.

Codzgarage is a client-first Custom Software Development Company that provides you with the best-in-class custom software development solutions with ease. Contact us today!

The InsurTech solutions have made it much more convenient to assess financial needs, evaluate risks, process claims, detect legal fraud, legal validation, etc. This article will drive you through an end-to-end analysis of how the very system influences and transforms the insurance industry.

Let’s drill down!

What InsurTech Solutions Actually Are?

Before digging deeper and knowing how InsurTech is one of the software development trends and its impacts on the insurance industry, let’s understand a bit about it! InsurTech refers to a kind of software solution developed and implemented to improve the efficiency of the insurance industry. The system powers and accelerates the creation, distribution, and better administration of insurance businesses.

InsurTech systems assist insurance companies in assessing additional opportunities outside the traditional efforts, which may include:

- Small Business Insurance

- Dynamically-Priced Insurance

- Social Insurance, and the like.

The system provides insurance companies with access to data streams from IoT devices. Apart from that, it develops a kind of dynamic pricing system based on market conditions and customer behavior.

What Is The Importance of InsurTech Software?

InsurTech plays a significant role in systematizing many processes, from applying for coverage to the payment and all. However, it isn’t limited to it. Yes, you’ve got that right. Below mentioned pointers are gesturing the significance of InsurTech companies and their solutions in the insurance industry:

- Enriched Customer Experience: InsurTech employs technologies that allow customers to get engaged, choose offerings as per their needs, and get tailored services with ease and convenience. Besides, it frees them from visiting branches to speak to a representative, ensuring an enhanced user experience.

- Appropriate Flexibility: Ensuring customized, transferable, and short-term plans, the modern InsurTech ensures to remain flexible. It denies looking for long-term arrangements, providing individuals with tailored plans and coverage based on their specific requirements over an ascertained duration.

- Improved Efficiency: Insurers and policyholders can research and explore alternatives utilizing the internet and apps without waiting for an available representative or business hours. There are InsurTech companies out there empowering users to access the information they need in no time.

- Emphasized Individuality: Bestowed by its innovative nature, information accumulation, and data processing, InsurTech solutions understand the individual’s needs better. It not only optimizes the pricing but also ensures the delivery of reliable coverage driven by historical data.

- Mitigated Chances for Fraud: InsurTech Solutions, employing trend analytics, data analytics, machine learning, and the like, can conveniently point out fraudulent activities if any inconsistency in data gets found. Apart from that, big data is more likely to find potential loopholes, enabling users to choose to close them to circumvent exploitation.

- Cheaper Operational Costs: The time has long gone when insurance companies would rely on traditional brick-and-mortar locations requiring manual workers. With InsurTech solutions, they can operate from anywhere with staff engaging with customers across the world. It lessens the overall operational cost.

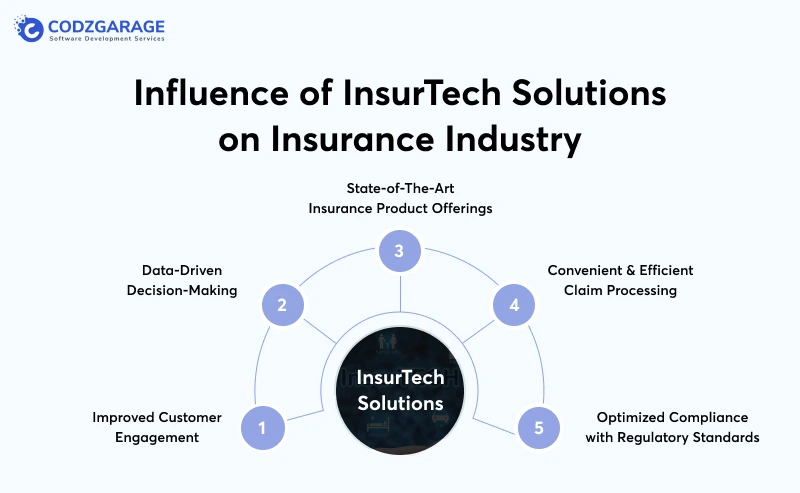

How Does an InsurTech Solution Influence the Insurance Industry?

There are several ways in which InsurTech solutions impact the insurance industry; however, some of them you should know are given below!

Improved Customer Engagement

InsurTech is revolutionizing the way to customer engagement in the insurance industry. Gone are the days when insurers would remain dependent entirely on agents and call centers for establishing interaction with policyholders. Now, with digital InsurTech solutions, mobile apps, chatbots, and the like, insurers tend to engage with customers way more efficiently.

- It ensures round-the-clock services and customer support, providing policyholders access to information with no time limitation.

- Leveraging data analytics, InsurTech tends to personalize interactions, tailoring recommendations and communications as per individual’s preference.

- Digitally enabled onboarding processes ease policy enrollment, lessening the paperwork and streamlining time to coverage.

Data-Driven Decision-Making

The abundance of data has always been one of the core ingredients of insurance. Thanks to the InsurTech solutions that take it to the next level. Innovative InsurTech systems employ advanced analytics, AI algorithms, machine learning (ML), and predictive modeling to get actionable insights from large databases. It transforms the way they analyze price, policy, and risks and detect fraud.

- Now, an insurer, utilizing real-time data and predictive models capable of considering an individual’s risk profile, can underwrite policies with excellent exactitude.

- With InsurTech’s competencies to monitor and assess customers’ behavior, insurers can reward healthy lifestyles, safe driving, and any desirable habit at mitigated premiums.

- InsurTech’s machine learning (ML) algorithms are capable of recognizing the patterns indicating fraud to assist insurers in dealing with fraudulent claims efficiently.

State-of-The-Art Insurance Product Offerings

InsurTech software solutions have revolutionized the way insurance product offerings are made. Organizations have initiated creating microservices policies, usage-based insurance plans, on-demand coverage, and tailoring products and services to the individual’s unique requirements. The policy pricing has also been granular and specified, which ensures the user’s actual risk profile.

- Telematics and IoT-enabled InsurTech software solutions allow insurers to offer a uses-based insurance policy for which the premium gets determined by the customer’s real-time data, like driving behavior and the like.

- The system makes it possible to provide microinsurance policies capable of offering appropriate coverage and understanding claim risk.

- With InsurTech, insurers can offer parametric insurance that pays out based on predefined triggers, for instance, weather conditions, seismic activities, and the like, enabling streamlined compensations to the policyholders.

Convenient & Efficient Claim Processing

The days of manual preceding have long gone. Now, they’re getting replaced by the automation that allows insurers to claim timelessly, mitigating administrative tasks and streamlining underwriting procedures. It helps you strengthen efficiency and elevate the benefits. The innovative InsurTech systems have streamlined many of the procedures in the insurance industry by automating them.

- Remarkably streamlined and accurate claim processing using Artificial intelligence (AI).

- InsurTech makes use of blockchain technology to develop transparent and unchangeable records, mitigate disputes, and ensure fair claims settlements.

- The system enables policyholders not only to make claims but also to track them via user-friendly mobile applications, lessening the need for extensive paperwork, phone calls, and the like.

Optimized Compliance with Regulatory Standards

Compliance with the regulatory standards has always been the core concern for insurers. Thanks to the InsureTech solutions, facilitating the hassle and ensuring better security compliance. Making use of RegTech competencies in the insurance industry, compliance professionals can effectively respond to the constantly changing regulatory requirements while keeping an eye on high-performance business activities. It helps them be valuable partners and insurance advisers.

- InsurTech solutions automate regulatory reporting needs, mitigating the chances for errors and making sure of on-time compliance.

- The smart contracts based on Blockchain technology automatically execute and enforce compliance with regulatory needs, thereby lessening legal risks.

Some Top InsurTech Software Usage Examples

Now that we’ve assessed how InsuirTech solutions are influencing the insurance industry, you may want to know some examples of real-time insurance technology uses. Don’t worry! There you have it!

Metromile

Metromile tends to be a state-of-the-art use-based InsurTech solution that has completely disrupted traditional auto insurance pricing, providing considerable savings on costs to customers. The system charges policyholders with tailored premiums made based on the number of miles they drive.

Root Insurance

Root Insurance happens to be an online car insurance company that makes use of telematics as well as sophisticated mobile applications to track the behaviors of drivers. This accumulated data makes an elephantine difference in determining the insurance premium, making it more personalized.

Lemonade

Another example of an InsureTech solution is Lemonade. It’s an insurance startup that employs sophisticated insurance software solutions with built-in AI tools for streamlined claim processing. It sets new industry standards for claim efficiency. Lemonade is an AI-powered system that assists you in mitigating processing time and boosting the customer satisfaction rate with your business.

Signing Off…!

That’s pretty much about the InsurTech software development! We discussed every possible aspect of InsurTech solutions based on how they are making a difference in the insurance industry. We started this guide by defining what the InsurTech solution actually is, then we defined its importance and, eventually, assessed how the very system is making a difference to the insurance industry. Now that you’re familiar with most of the aspects, you‘re more likely to be eager to develop one for your company, too.

If you need InsurTech software development, you need to find one of the best InsurTech companies to get the system built with ease and convenience. Don’t fail to browse through our recent blog stating the facts about In-House vs Offshore Software Developer Costs, and then choose what suits you best! Hopefully, the article has helped you get to know the difference made by InsurTech solutions in the insurance industry!

Need

Consultation?Our expertise!

- 11+ years of experience

- Excellent expertise

- Timelly delivery

- Hire Now!

Kevin Bhut

Kevin Bhut